Why is the Dunning-Kruger Effect so relevant in the times of rising Demat Accounts?

For the first time in my life, I have seen so many people calling themselves “Stock Market Educators / Trainers” on Youtube. The number of people claiming to have world-beating money-making strategies is astounding (with a lot of them relying on the Youtube strategy for their own revenues).

Okay, think about it. How many times has someone approached you at a dinner party egging you on to invest in the ‘next best thing in the market’?

For most of us, this is a common encounter at office parties and events, and with information and communication at our fingertips, unsolicited advice from peers, family members, colleagues, and acquaintances has become the new normal. But why do we tend to claim expertise on subjects we know so little about?

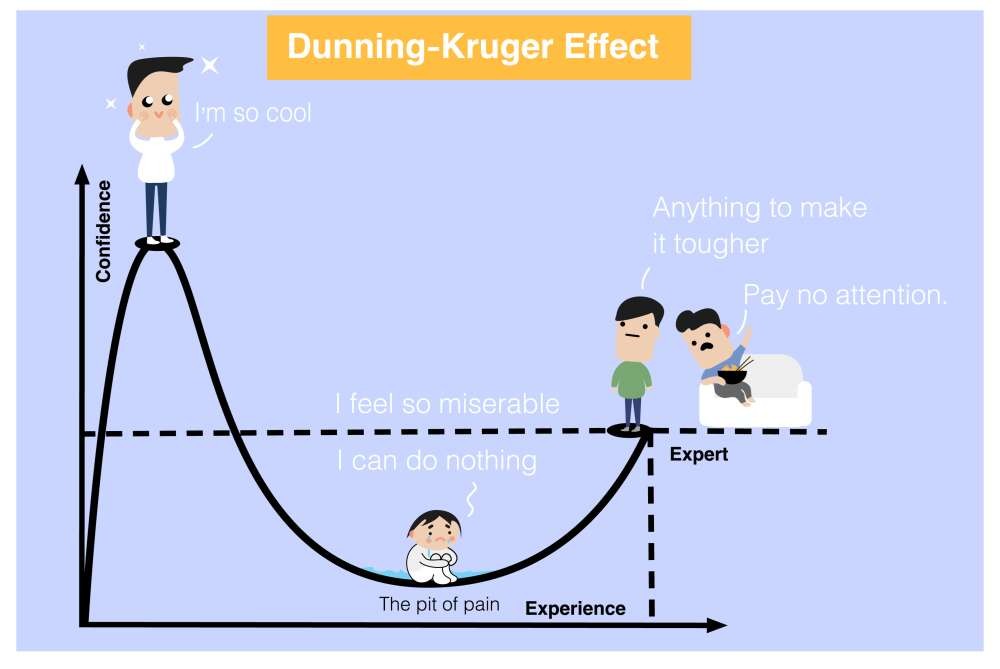

The Dunning-Kruger Effect is a commonly known cognitive bias in people where people assume that they have elevated knowledge and competence in an intellectual or social subject. They highly overestimate their expertise and inflate their capabilities in comparison to the performance of their peers or people in general. Most of us have faced this bias in our daily lives. Remember how your next door neighbour gave you relationship / family planning advice like they have it all sorted?

With the rise of fintech and digital platforms where Demat accounts can be opened in a few clicks, India has seen a steep rise in investments in equity last year. Close to 7.7 crores of Demat accounts were opened in 2021, along with the historic performance of the Nifty index last year. According to Business Standard- “The 30-share index finished the calendar year with a solid gain of 22 percent (10,503 points), after having touched a new lifetime high of 62,245 on October 19, 2021. The NSE Nifty settled 150 points higher at 17,354 and was up a whopping 24.1 percent for 2021.” Is a good thing. Of course. Increased investments in financial markets indicates how we are maturing as an economy.

But, there are aspects to be cautious about.

Financial Wellness influencers, articles on the internet, self-help resources, etc are instant sources of information that are being readily consumed by eager investors. Due to our current attention deficit crisis, where information has to be crunched down to 20-second bits to feed a bizarre algorithm, our financial knowledge is just that- bits and pieces crunched down to feed our hunger for content. While there needs to be recognition and praise for the recent rise in financial literacy, it needs to be strongly reiterated that watching a 2-minute video is not the sage investment advice we think it is. Due to our constant consumption of online content, it goes to inflate the current assumption of our knowledge and we not only end up harming our own financial health but also others by giving them the ‘latest’ advice you saw on an influencer’s account.

It is especially interesting to note the permeating implications of the Dunning-Kruger effect among millennials who are at the stage where they need to make important financial decisions related to real estate, family, retirement, loans, etc. This effect may enable them to invest impulsively in stocks while consciously avoiding conservative financial practices because of the inflated sense of expertise in the subject. As the conversation around finances become more informal and open, it is refreshing yet discouraging to see so many young people with flourishing investment accounts but so little knowledge about the companies they are investing in. Very recently, I spoke to a 25 year old entrepreneur who wasn’t sure what a bank deposit was but was feeling all the FOMO for not investing in Crypto. This could be an exception. And I hope it was (No she did not have the risk appetite).

While the Dunning Kruger Effect may be a prevalent cognitive bias, as is famously said ‘To Err Is Human’-the recent wave in talking about financial matters and topics openly has had a refreshing and positive effect on how we see the money. If only we focused on quality education, and not quality advertising, what we have going on in the digital space, could actually be a revolution.

Creator - Online Personal Brands | Built 5K+ Personal Brands On Social Media, Globally | National-level Awardee "Social Media" | LinkedIn Creator Accelerator Program '22 | YouTube Creator Academy '15 | Event Curator

2yI love how you ended this article with “If only we could focus on quality education, not quality advertising…” You’re absolutely right Shruti. The bias and the FOMO are making people act like the hare in the race, and not the tortoise. This is a profound take on the mushrooming Financial Educators of today.

TEDx Speaker // NAAEE 30 Under 30 // Founder at Upcycler's Lab // Global Shaper // Environmental Education

2yVery well articulated

Chief of Schools and Alumni at Akanksha Foundation| Ex - TFI I Podcaster I Lawyer

2yGreat article Shruti Agrawal, CFA! What is your take on apps like Groww, Scripbox, ET Money etc. Do you think they are step forward towards enabling more reliable information and decisions or do you think it contributes further to the Dunning Kruger effect?

Real Estate Top Voice | Smarter investment in Real Estate | Smart Cities | Jewar | Dholera | Noida | YEIDA

2yLoved it... Great product will any day beat great advertising... But it makes the road difficult for real advisors.

SAP CERTIFIED BACK END DEVELOPER

2yIts because the investors dont have the knowledge whom to choose wether to go with the professionals or youtubers or Telegram channels Or Twitter or facebook or whatsapp as the content is free in youtube , Investors should only trust the persons who have sebi registration , In youtube if there is a option like if you dont have sebi registration then please dont post or talk about stock markets not only youtube all the platforms. 1) CFA/CFP - Long term advisors 2) NISM RESEARCHERS 3) CMT- For short term trading 4) NISM certified stock brokers The above are the stock market professionals the investors should consult People should know whom to consult or listen to , if not everything will be fraud